Information Center

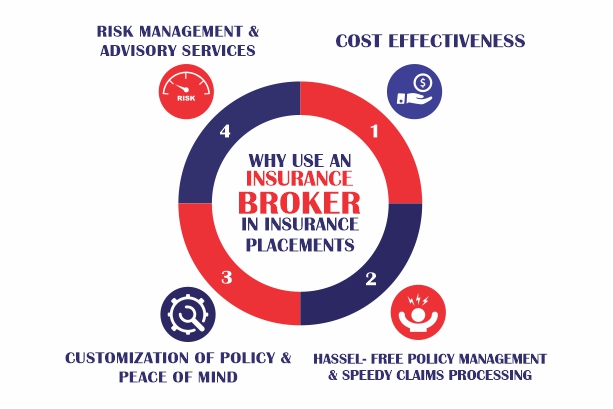

WHY USE AN INSURANCE BROKER IN INSURANCE PLACEMENTS

The use of an insurance broker in insurance transactions have been proved over time to give the following values to the insuring public be they individuals, commercial or corporate entities:

COST EFFECTIVENESS

One of the challenges that usually frustrate consumers of insurance is the issue of knowing coverage adequacy and premium payable. By segregating the risks and properly evaluating them vis a viz policy conditions, the broker negotiates and secures favourable premium. Unlike other products, insurance is interwoven with technicalities with some unnecessary clauses, terms, and exceptions. All these have cost implications. The broker choses only those terms and conditions specific to his client’s needs and pays the necessary premium. These and other services of the brokers are provided freely because the law provides for the deduction of brokerage commission from the premium due to insurers.

HASSEL- FREE POLICY MANAGEMENT AND SPEEDY CLAIMS PROCESSING

Having chosen the necessary covers, given the details of his client’s risk exposure, the broker concludes the risk placement at a cost effective premium and continues managing the relationship between the insurance underwriter and his client. Throughout the value chain and especially at the time of claim, the broker bridges the gap and completes all documentations speedily and obtains indemnification in good time. The usual delays in the insurance value chain are drastically reduced while favourable indemnity to the client is assured.

CUSTOMIZATION OF POLICY AND PEACE OF MIND

Every business requires insurance covers that are in sync with its operation. In selecting policies for its clients, the broker employs his knowledge and experience of insurance in adapting specific contractual wordings to suit to the client’s business. The inherent operational oversights that turn out to be disadvantageous at the time of claim are usually discovered during periodic reviews and appraisal meetings with clients.

RISK MANAGEMENT AND ADVISORY SERVICES

Part of the free services rendered by brokers to their clients is risk management. Usually, compliance with insurance warranties is synonymous with getting claim payment without penalties or even outright repudiation.

The broker inspects and suggest ways to improve the standard of housekeeping in his client’s activities. Periodic reviews and staff engagement on ways to minimize risks factors has a dual advantage of premium reduction and overall productivity or capacity enhancement for clients especially those engaged in manufacturing and engineering endeavors.

OUR VALUED CLIENTS

Since our inception in 1992, we have enjoyed tremendous supports from our pioneer customers. These are:

Tecon Oil Services Limited

WINCO Foam Industries Ltd

Coscharis Motors Limited

Coscharis Technologies Limited

Ekcel Works Limited

Expo Solutions Nig Ltd

Ferratto Industries Limited

Frazimex Engineering Limited

Nigerblossom Drilling Co Ltd

Spectranet Nigeria Limited

Oilserv Limited

Now Now Nigeria Ltd.

Sir Emeka Okwuosa Foundation

Point Technologies Limited